As we head into 2021, I wanted to provide a year-end update of the office, industrial, and retail market in Orlando. My executive summary will focus on the business owners and private investors we primarily represent rather than the capital market.

Office

It will come as no surprise that office demand has weakened considerably since the pandemic commenced. In fact, this is the first time that Orlando has seen three consecutive quarters of negative office absorption in more than 20 years.

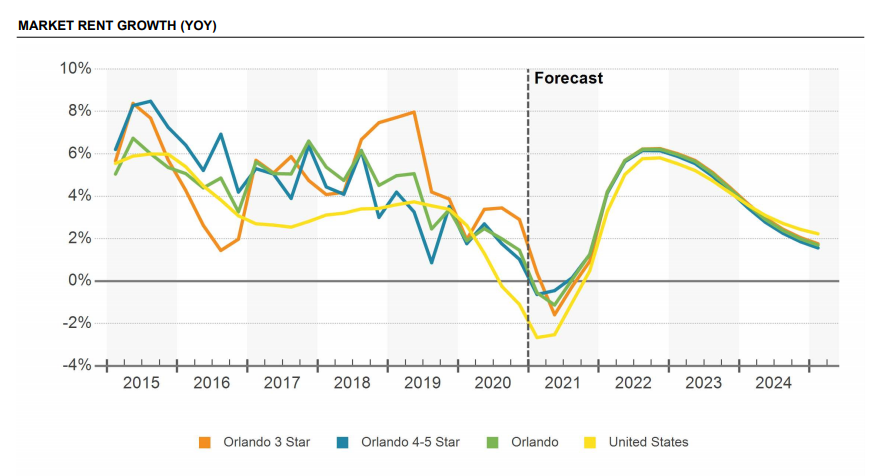

Asking office rental rates have certainly felt the pandemic impact falling 200 basis since the start of 2020. Over the same period, the average vacancy rate has risen over 100 basis points as well resulting in a decade-high amount of new office supply and faltering office demand.

The office sector is likely to be among the most impacted long-term by the pandemic especially with the Orlando market’s high exposure to at-risk employment industries such as the hospitality sector.

Industrial

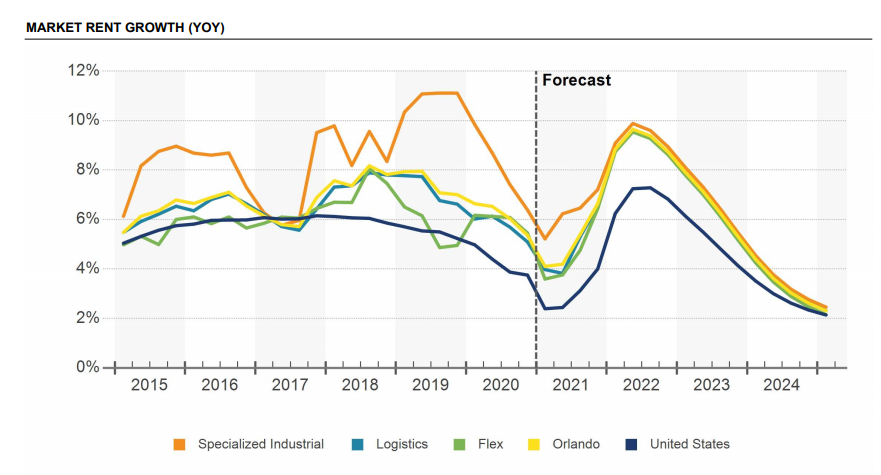

While the Orlando’s economy has been significantly disrupted by the coronavirus pandemic, the industrial sector has not been heavily impacted. One of the few areas of pandemic impact for Orlando’s industrial sector is asking rents, which has downshifted 150 basis points. However, this still remains well above the national average of 3.65 year-over-year.

Echoing national trends, firms are in need of expanded storage and/or distribution spaces, ultimately driving demand in submarkets close to high population growth neighborhoods. However, the Orlando market faces stiff competition from nearby Lakeland with respect to prospective tenants looking to enter the Central Florida market due to its greater availability of modern logistic space at lower asking rents.

Retail

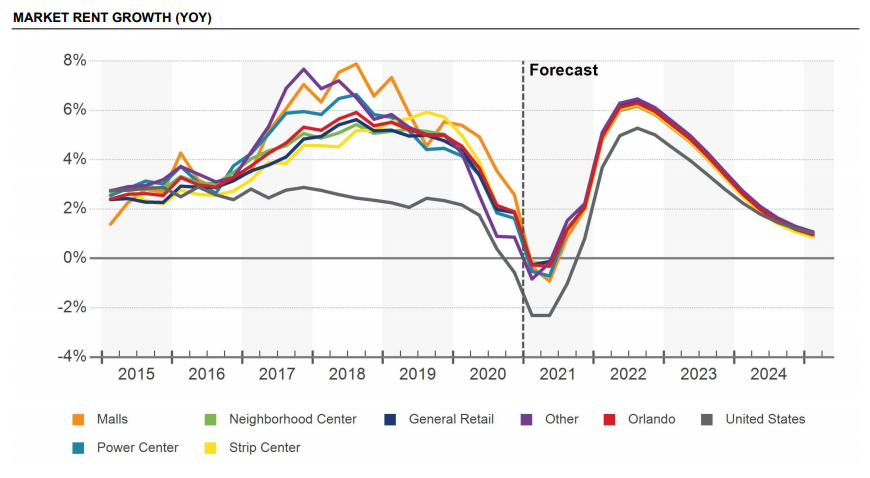

Orlando’s retail sector has held up well to the ongoing pandemic. After softening in the second and third quarters of 2020, retail demand bounced back in 20Q4. The average vacancy rate has remained virtually unchanged since 20Q1 and remains less than 50 basis points above the lowest market on record.

There could be loosening retail fundamentals on the horizon due to the lagged absorption and vacancy hits looming from announced retail closures. Retail annual rent growth has taken a beating from the pandemic dropping almost 400 basis points since 20Q1. Landlords appear hesitant to push asking rents in this environment.

There was an increase in large-box vacancies in 2020, though it wasn’t a new trend for Orlando and the market has been able to backfill comparable spaces including significant adaptive reuse such as call centers or outparcels.

Source: CoStar Market Insights