Winter Garden’s Theater Revival, National Home Sales Slowdown, and Florida’s Resilient Migration Trends | Monday Market Update | May 5, 2025

By Amy Calandrino, Beyond Commercial

This week’s Monday Market Update brings you a curated look at local, regional, and national developments shaping the business and commercial real estate landscape — from the historic charm of Winter Garden to the broader U.S. housing market, to Florida’s powerful real estate trends for 2025.

Let’s explore what’s happening and why it matters.

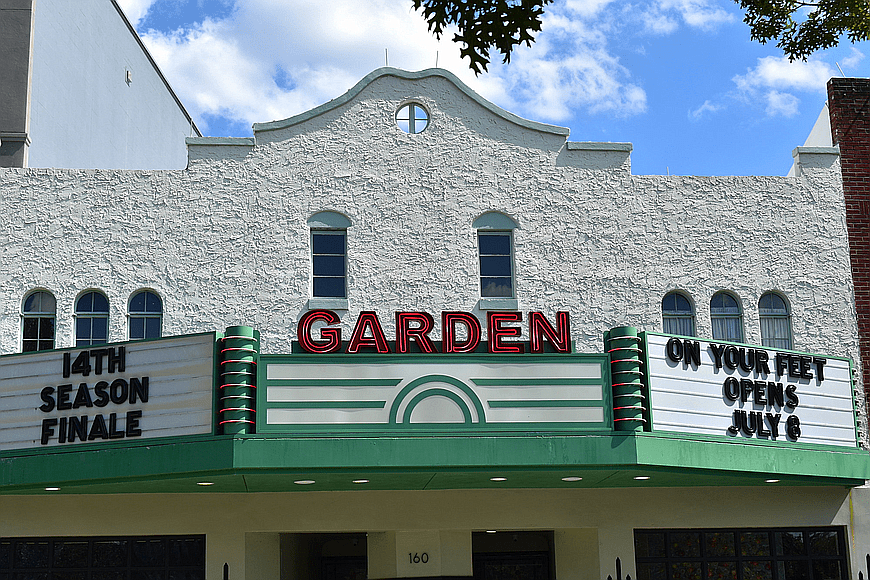

🎭 Hyperlocal Spotlight: Winter Garden’s Garden Theatre Eyes Revival

According to ClickOrlando, Winter Garden city leaders are moving forward with a fresh vision to revive the historic Garden Theatre after its financial collapse in 2023.

Key Details:

- $1 million allocated for a city-led business plan to reopen the theater.

- Plans to expand programming and potentially introduce public-private partnerships.

- Commitment to preserving historic architecture while modernizing operations.

CRE and Economic Impact:

- Cultural anchors like theaters drive foot traffic to downtown districts, supporting local restaurants, shops, and service businesses.

- Revitalized entertainment venues increase demand for mixed-use development and boutique hospitality projects nearby.

- Successful reopenings can strengthen property values and community identity, making neighborhoods more attractive to both residents and investors.

🏡 National Outlook: March Home Sales Stumble in Slow Spring Start

The national housing market saw a slow start to the spring buying season, as reported by ClickOrlando.

Highlights:

- March home sales dropped 4.3% compared to February, reflecting lingering high mortgage rates and buyer hesitation.

- Inventory levels remain tight, but price growth has moderated in many markets.

- Industry analysts suggest that buyers are waiting for more favorable lending conditions before re-entering the market.

CRE Takeaways:

- Sluggish residential activity can spill over into consumer spending, impacting retail leasing and small business performance.

- Developers and investors should watch regional variations closely — some markets may rebound faster depending on local economic conditions.

- With housing affordability still under strain, demand may shift toward multifamily rentals and build-to-rent projects.

🌴 Florida Real Estate Trends: Migration Keeps Fueling Growth

Despite national headwinds, Florida’s real estate market remains uniquely resilient heading into mid-2025, according to Florida Realtors’ 2025 Real Estate Trends.

Key Drivers:

- Florida remains a top inbound migration state, especially from high-cost, high-tax states like New York, New Jersey, and Illinois.

- Markets like Orlando are outperforming other metro areas, thanks to strong job growth, international migration, and diversified industries.

- Despite higher interest rates, Florida housing prices continue to climb — driven by persistent demand and constrained supply.

What This Means for CRE:

- Inbound migration fuels housing demand, retail expansion, and office absorption.

- Investors can benefit from focusing on fast-growing submarkets within Florida, such as Central Florida and the Orlando metro area.

- Developers should stay nimble, balancing for-sale and rental product to match shifting consumer preferences.

Final Thoughts

As we head into May, Orlando continues to shine as a critical hub within Florida’s broader success story. From preserving historic treasures like the Garden Theatre, to leveraging the state’s migration-fueled growth, to watching national market movements, staying informed helps position you ahead of the curve.

Until next week,

Amy Calandrino, CCIM, SIOR

Founder & CEO, Beyond Commercial